Unlock Tax Credits with an Energy-Efficient House

Did you know that you can earn tax credits from the government with an energy-efficient home? Including credits for roofing!

Homeowners can get up to $5,600 for green home improvements.

The government plans to invest over $2 billion in the Canada Greener Homes Grant. This will assist more than 700,000 homeowners in making eco-friendly retrofits.

The government has committed $4.4 billion over 5 years to provide interest-free loans. There will be loans up to $40,000 for deep home retrofits which will benefit up to 200,000 homeowners.

We spoke to government representatives from NRCan to build this article for homeowners looking to get the most out of their homes. If you're looking to renovate your house, it may now be a perfect time to do so.

Federal Tax Credits for Roofs in Canada

The Canada Greener Homes Grant offers financial support to energy-efficient homes.

Eligible homeowners in Canada can choose from a variety of options. But, this grant will cap out at $5,600 per home or $40,000 for deep retrofits in 2021 and 2022.

Criteria

All homeowners in Canada can participate in this initiative. Only one homeowner per home can register, and there are eligibility requirements that must be met. Applicants are required to:

- Provide proof of ownership with your property tax bill number (this number can be found on your municipal property documents).

- Show proof of primary residence with a valid ID or utility bill.

Tax Credits in Alberta

Edmonton

Building Energy Benchmarking Program

This program helps building owners improve energy efficiency through subsidized green initiatives. Participants receive technical support, benchmarking reports, and tenant workshops. Up to $1,500 in financial incentives to reduce greenhouse gas emissions and cover energy audit costs.

Lethbridge

SunRidge Built Green Homeowner Rebate

This program promotes green practices to reduce residential environmental impact. Built Green™ promotes sustainable communities. They provide homebuyers with financial incentives for energy-efficient practices.

Medicine Hat

ENERGY STAR® Air Conditioner Incentive Program

The Air Conditioner Incentive Program gives rebates for energy-efficient air conditioner installations.

EnerGuide® Ratings for New Homes Incentive Program

This program provides financial compensation for the development of energy-efficient homes. The rebate amount for the home energy savings is based on the evaluation by an energy advisor.

Get rebates for energy-efficient appliances and renewable energy installations in your home.

Solar Electric Incentive Program

If you're thinking of installing a solar PV system into your home, you could earn a tax rebate from your local government.

Municipal Climate Change Action Centre

Alberta Municipal Solar Program

Alberta's Municipal Solar Program offers funding up to $1.5 Million for installing solar PV systems that cut energy costs.

Clean Energy Improvement Program

Get support and financial incentives for developing property-assessed clean energy properties.

Electric Vehicles for Municipalities Program

$750,000 in funding is available for purchasing electric vehicles and related products.

Municipal Energy Manager Program

This program provides up to $160,000 in funding to subsidize 80% of a dedicated Municipal Energy Manager's salary.

Recreation Energy Conservation Program

Recreational facilities can receive funding by saving energy and reducing emissions.

This program provides up to $3 million in funding for schools across Alberta that wish to install solar PV systems in their facilities.

Tax Credits in B.C.

B.C. has several initiatives to help homeowners achieve a more sustainable home. A list of programs available in the province has been provided below:

Non-profit and Aboriginal Housing Upgrades

This program offers free assistance to non-profit housing providers and Aboriginal communities. This is for installing energy-efficient products in homes. This also includes reducing energy costs and saving tenants' money

Power Smart for Low-Income Households - Energy Conservation Assistance Program

Low-income residents can get free home energy evaluations. It also includes energy-saving product installations and personalized energy-saving advice.

Tax Credits in Manitoba

Manitoba has several initiatives to help homeowners achieve a more sustainable home. A list of programs available in the province has been provided below.

Métis Energy Efficiency Offers

This program provides free and discounted energy-efficient upgrades. This is in collaboration with the Manitoba Métis Federation.

Tax Credits in Ontario

Ontario has several initiatives to help homeowners achieve a more sustainable home. A list of programs available in the province has been provided below.

Toronto Home Energy Loan Program (HELP)

The program provides low-interest financing for residents to enhance home energy efficiency and save money.

A Home Efficiency Rebate from Enbridge Gas

This program provides homeowners with up to $5,000 in funding for energy-efficient home renovations.

Tax Credits in Quebec

Quebec has several initiatives to help homeowners achieve a more sustainable home. A list of programs available in the province has been provided below:

Financial assistance is available under this program for the replacement of fossil-fueled systems with energy-efficient systems.

This energy renovation program for qualifying homeowners includes an energy audit conducted both before and after a retrofit.

Tax Credits in P.E.I

PEI has several initiatives to help homeowners achieve a more sustainable home. A list of programs available in the province has been provided below.

Home Energy Audit Program

Efficiency PEI supports homeowners by subsidizing EnerGuide home evaluations and upgrades.

The program provides rebates for ENERGY STAR® certified heating equipment, water-saving devices, biomass heating devices, and other energy-efficient products.

Building Envelope Upgrade Rebate

Rebates are available for the following:

- Insulation

- ENERGY STAR® windows & doors

- Air sealing improvements

Tax Credits in Newfoundland & Labrador

takeCHARGE Energy Efficiency Loan Program (EELP)

This program provides financial assistance for purchasing and installing qualified heat pumps, insulation, and home energy assessments. The payments are conveniently made through monthly electricity bill subsidies. This subsidy will be in the form of a reduced interest rate.

Home Energy Savings Program (HESP)

This provincial initiative is designed to assist households with low income who consume 15,000 kWh of electricity annually in making energy-efficient retrofits to their homes.

takeCHARGE Insulation Rebate Program

This program offers residents a rebate for 75% of basement insulation and 50% of attic insulation costs.

Tax Credits in Nova Scotia

This program offers rebates of up to 80% on energy-efficient upgrades for eligible rental properties and up to 100% for providers of rent-free housing.

Clean Energy Financing Program

If you live in one of 7 participating towns & municipalities, you can get cleaner energy for your home and pay for it at a pace that is affordable for your family.

Home Energy Assessment Program

This program offers support to homeowners in the form of EnerGuide evaluations, rebates, and/or low-interest financing.

Tax Credits in New Brunswick

Low-Income Energy Savings Program

This program offers support for low-income homeowners in need of major energy efficiency upgrades.

Total Home Energy Savings Program

This program offers money back on efficiency upgrades to homeowners looking to make their homes more energy-efficient. This includes insulation, air-sealing, high-efficiency central heating systems, windows, doors, and much more. It also honours ENERGY STAR-certified products.

New Home Energy Savings Program

This program offers custom recommendations to resident's building plans and access to up to $10,000 in incentives for energy efficiency improvements.

Tax Credits in NW Territories

The NW Territories has several initiatives to help homeowners achieve a more sustainable home. A list of programs available in the province has been provided below.

Rebates on Energy-Efficient Home Improvements

This program provides funding to homeowners of less energy-efficient homes in the Northwest Territories (NWT) to reduce the costs and GHG emissions associated with heating their homes.

Rebates on Energy-Efficient Products

This program offers rebates to northern residents who purchase new, more energy-efficient products that they use every day (including ENERGY STAR-certified models).

Rebates on Renewable Energy Products

This program provides funding for renewable energy sources. These include solar, wind, wood pellet heating, biofuel/synthetic gas, and ground source heat pumps.

Tax Credits in Nunavut

Nunavut has one initiative to help homeowners achieve a more sustainable home. A description of the program has been provided below.

This program offers financial support, along with technical assistance, to homeowners who are looking to perform major repairs, renovations, or additions to their houses. Applicants who have previously received assistance can apply for an additional $15,000 to create a more energy-efficient home.

Tax Credits in Yukon

Yukon has two initiatives to help homeowners achieve a more sustainable home. A description of the programs has been provided below.

The program offers rebates that encourage energy efficiency in decision-making when purchasing certain household appliances, products, services, and heating systems.

Incentives for Appliances, Heating Systems, and Water Conservation

Apply for rebates on ENERGY STAR-certified products for your home.

Tax Credits by Province

- Alberta

- British Columbia

- Saskatchewan

- Manitoba

- Ontario

- Quebec

- Northwest Territories

- Nunavut

- Yukon

- Prince Edward Island

- Newfoundland & Labrador

- Nova Scotia

- New Brunswick

Each province offers a variety of rebate programs, as listed above. If you're looking for general information, we recommend contacting NRCan at 1-833-674-8282 for more information.

The Tax Credit Application Process

In order to qualify for these green government initiatives, you need to follow these steps:

1. Learn about the intiative

Ensure you meet the eligibility criteria, review the requirements, and learn about the process by clicking here.

2. Register and book your pre-retrofit evaluation

In order to participate, you must register online through the Greener Homes Grant portal. Up to 700,000 grants will be available, and your evaluation will be performed by an NRCan-registered energy advisor.

3. Plan, document, and complete your home retrofits

You'll receive your evaluation in the portal, and after such time you can begin your upgrades. You will need to complete at least one retrofit that is both eligible and recommended by your energy advisor. You can find your home's recommendations in your Renovations Upgrade Report and on the online portal.

4. Book your post-retrofit evaluation and apply for reimbursement

Once you've completed your retrofits, you can book your post-retrofit evaluation and submit your documentation for reimbursement. Your new EnerGuide label will show you how your home has improved.

5. Receive your reimbursement

You will need to confirm your grant total in the online portal, and then a cheque will be sent to you.

How and Where To Apply for Tax Credits

You can apply online for each grant or loan listed. For the federal grant, you can apply on their website. You'll need to provide proof of identification and homeownership. You will also likely need to complete a home evaluation, for which you can be reimbursed by the government.

The government has also provided resources on purchasing an energy-efficient home and how to make your current home more energy-efficient with small changes. As both these initiatives are primed to launch in 2021, you will have the next few years to apply. Earn money from the government by simply making eco-friendly upgrades to your home that will also save you money in the long run.

Breakdown of Tax Credits

Depending on what you're looking to do with your property, you can receive a significant amount from the government to help you complete it. The grants will provide up to $5,600 total towards energy-efficient retrofits and don't require recipients to repay the amount.

The $40,000 loans are interest-free to assist homeowners in bankrolling their green renovations but do require repayment.

While the interest-free loan initiative has yet to launch, you can currently apply to receive the grant. Some of the eligible retrofits include but are not limited to:

- Home insulation: Update your eligible attic/ceiling, exterior wall, exposed floor, basement or foundation, and crawl spaces.

- Air-sealing: Perform air sealing to improve the air-tightness of your home to achieve the air-change rate target.

- Windows and doors: Replace your windows or glass doors with ENERGY STAR® certified models.

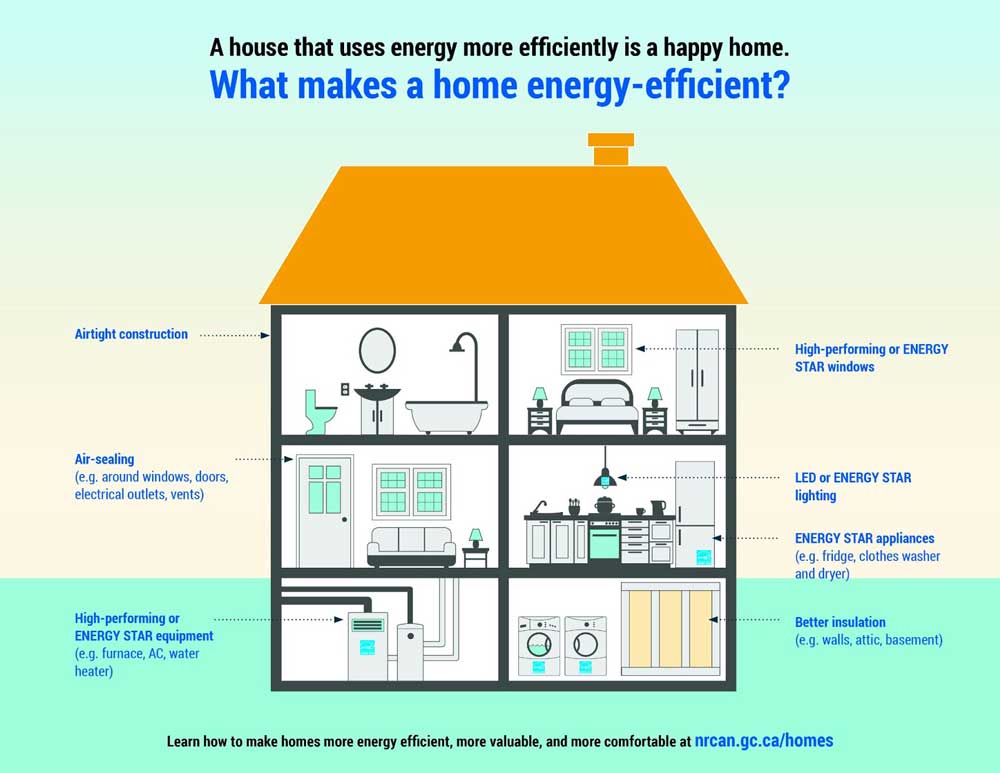

Energy-Efficient Housing

Any home can be energy-efficient regardless of when or where it was built. So, what makes a home energy-efficient?

Cost-Effective

There is reduced energy consumption, resulting in lower utility bills over time.

Comfortable and Healthy

Ensures optimal temperature control, improves indoor air quality, and reduces drafts.

Always Adding Value

Efficient fixtures and upgrades add value and appeal. Also, new windows, doors, lighting, and appliances save money and energy.

Kind to the Environment

Efficient fixtures and upgrades add value and appeal. Also, new windows, doors, lighting, and appliances save money and energy.

Energy-Efficient Roofing

Energy-efficient roofing reflects heat and keeps your home cool. It can save you money on energy bills and earn you tax credits. Your roof absorbs 90% of the sun's heat, so replacing it with energy-efficient materials can save you a lot on cooling costs. We can discuss which program is best for you once each initiative is fully implemented.

There are a few ways you can make your roof energy-efficient. Let's look at some examples.

Cool Asphalt Shingles

New asphalt shingles have been coated with special granules to improve solar reflectance and meet cool roofing standards. These special shingles are a huge improvement compared to their counterparts. If your home heats up substantially in the summer, this material should definitely be on your list for your next round of improvements to your home.

Cool Roofing Tiles

Tile roofs are made from slate, concrete, or clay and are a very popular choice for roofing materials in some parts of the US and Mexico. They are typically glazed with a coating that waterproofs the tiles and provides custom colours for your rooftop.

Cool Metal Roof

Metal roofs keep buildings cool. Paint them light colors to reflect heat. Add reflective coatings for even better results.

Green Roofs

Green roofs are becoming popular on large buildings with flat or low-sloping roofs.

If you're considering a green roof, consider the cost and energy savings.

If you're replacing your roof, consider cool asphalt shingles.

If you're building a new home, consider a cool roof.

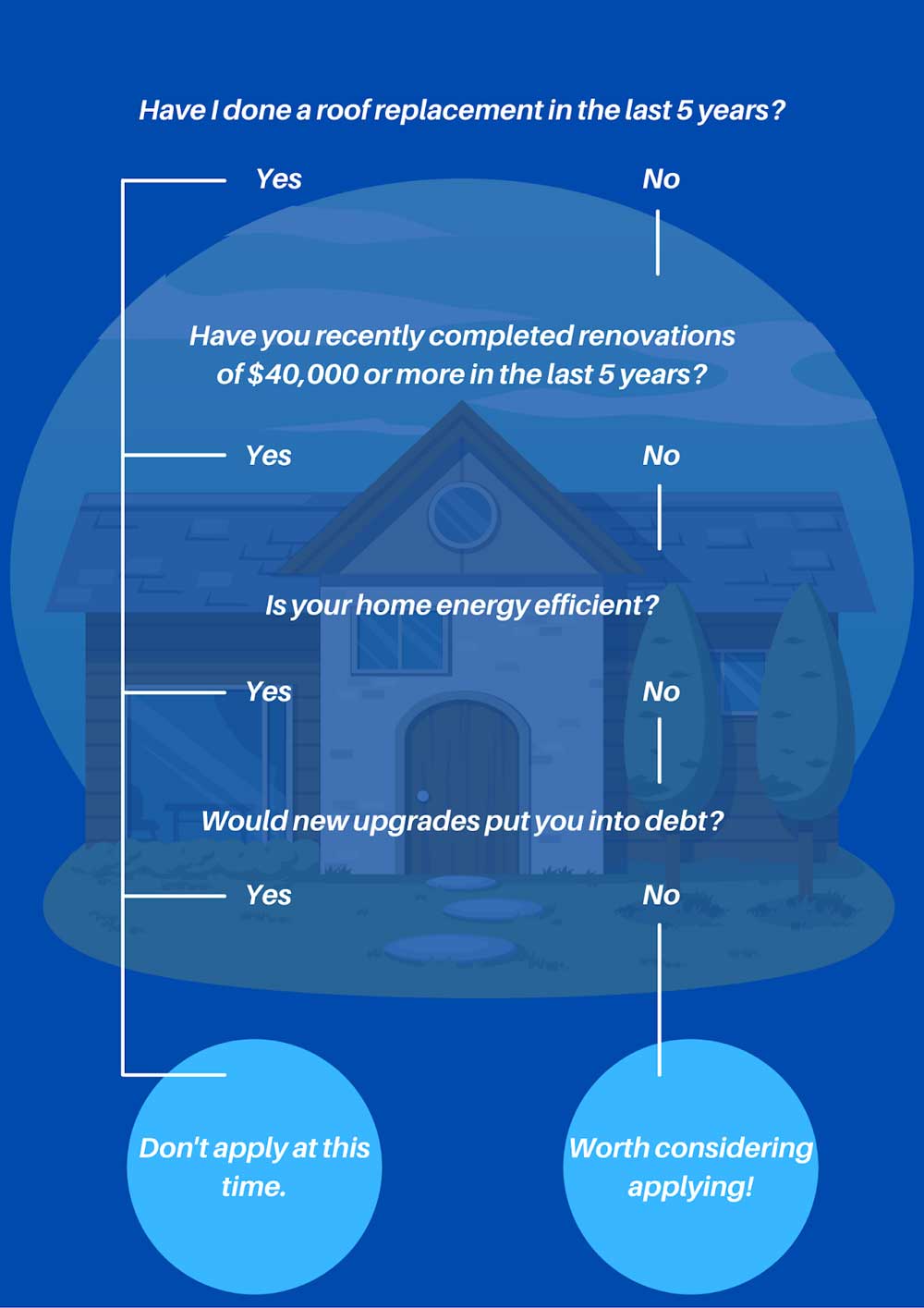

Is It Worth It?

Just because you can get government money doesn't mean you should. Upgrading your home to be more energy-efficient may not be the right decision at this time. Let's look at the decision chart below

A cool roof, or energy-efficient roof, can save homeowners up to 15% in cooling costs and perhaps more in extremely hot climates. As mentioned, determining whether you could benefit from a cool roof would require a small amount of investigative work on your home. But, you can make small changes today to start saving money on your energy bill:

- Reheat in the microwave. It's the most efficient option for reheating food.

- Use low power settings on devices to save power.

- Don't overfill the fridge. Make sure the items have room to breathe and that your fridge is out of direct sunlight.

- Pre-soak stained clothes. This will avoid re-washing.

- Turn off lights when you're not using them.

Canadian homeowners can access provincial grants for energy-efficient homes. Depending on your location, you may qualify for tax credits or grants specific to your province.

Conclusion

It's time to take a look at your energy bill and see what changes you can make to start saving every month. Small changes to your everyday life are a great way to get started.

Whether you stop rinsing dishes before you put them in the dishwasher or you look into purchasing some ENERGY STAR® appliances to save money.

You can also look at available government funding. One example is the Canada Greener Homes initiative. This is an initiative where they replace your roof or windows for something more energy-efficient.

Contact Fortress Roofing for expert assistance. We can secure your home with top-quality roofing materials and services.

Making your home more energy-efficient saves you time and money and keeps our planet healthy.

Consider making your next renovation green, and get government funding to assist in the process! Sounds like a win-win.